deferred sales trust attorney

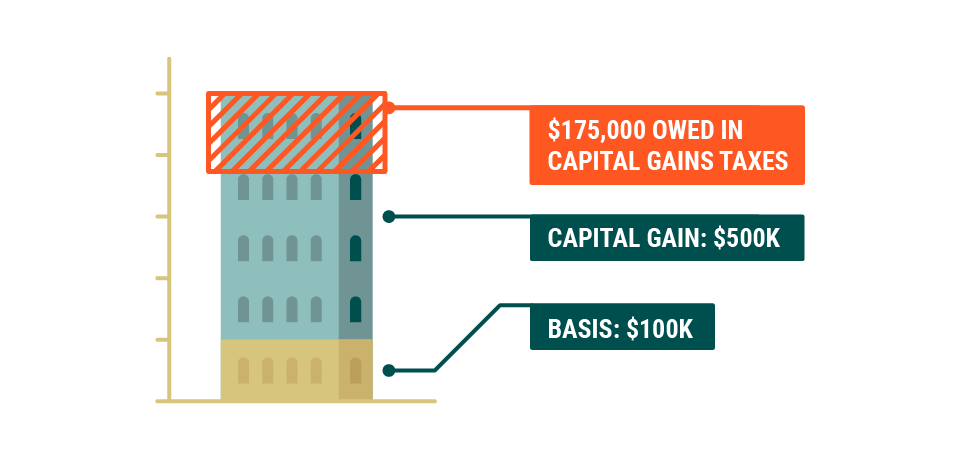

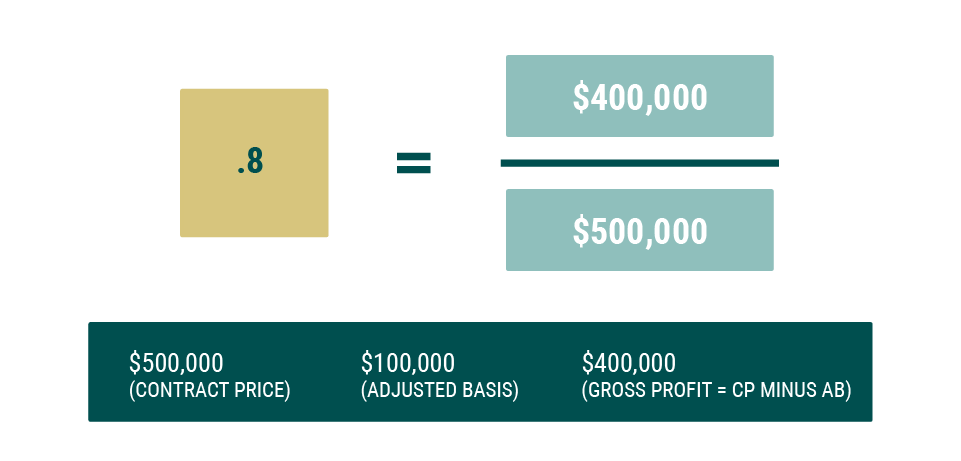

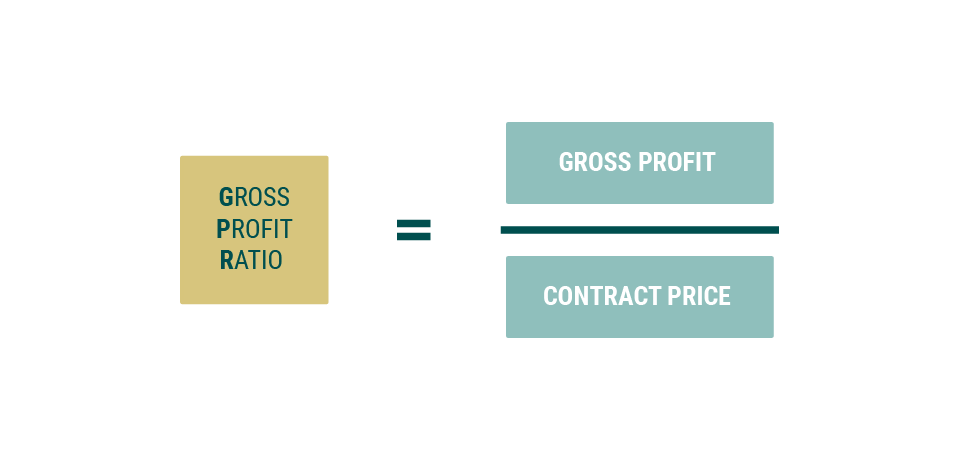

Deferred sales trusts work with Internal Revenue Code 453 which is a tax law that prevents a taxpayer from having to pay taxes on money they havent yet received on an installment sale. The DST starts with an owner of an appreciated asset who wishes to sell that asset and defer taxes on his or her gain.

Deferred Sales Trust The Other Dst

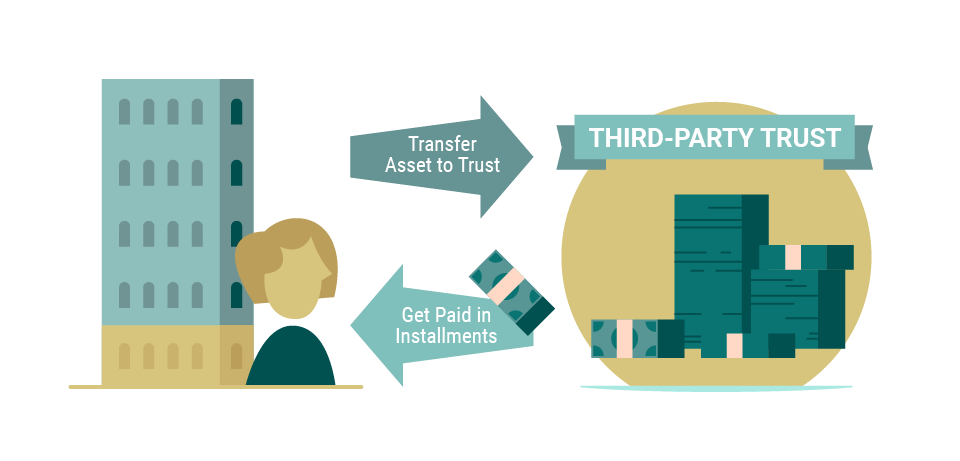

The Deferred Sales Trust is a Trust that purchases the Sellers property and then resells it to the ultimate buyer.

. Deferred sales trust attorney Wednesday March 16 2022 A third person the. There are significant benefits in electing to use the Deferred Sales Trust when selling a property or capital asset. Describe Your Case Now.

From Fisher Investments 40 years managing money and helping thousands of families. Ad You Have Rights. Current DST Properties and Sponsors.

A deferred sales trust The DST is a new alternative to the 1031 exchange that allows the taxpayer to defer the gain on a sale. Attorney Etc How can I know the amount of my payments from the trustee. The choice between a Deferred Sales Trust.

Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. Posted on May 2.

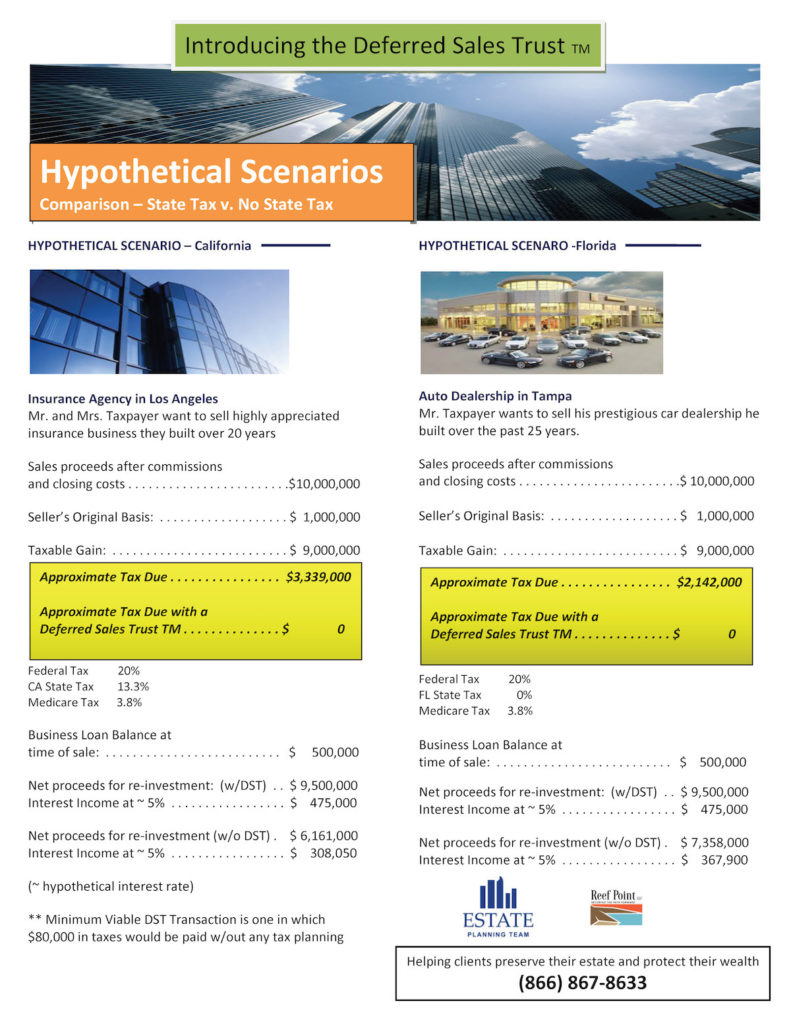

We Win Cases Free Evaluation Get Started. The Capital Gains Tax is like that mischievous guy thats not part of. The DST program is a great fit for clients who.

With a Deferred Sales Trust DST you can defer your Capital Gains Tax completely and legally too. Ad Find the Right Lawyer. Current DST Properties and Sponsors.

The tax attorney prepares the documentation and implements the Deferred Sales Trust at the close of sale either through escrow or attorney. When the appreciated property or capital assets. Entering a Deferred Sales Trust is an alternative to 1031 exchanges that property owners should consider to defer taxes while selling their assets.

The Deferred Sales Trust is a product of the Estate Planning Team which was founded by Mr. The Deferred Sales Trust is a legal contract between you and a third-party trust in which you sell real or personal property or a business to the Deferred Sales Trust in exchange. The Deferred Sales Trust is offered exclusively by Estate Planning Team members along with experienced and specialized tax attorneys.

100 Private and Fully Confidential. See Attorney Ratings Costs. If you require trust demonstrate what you.

Post Your Case Now. It allows the Seller to treat the sale as a Seller-carry back transaction where. Review Lawyer Profiles Ratings Cost.

A Deferred Sales trust allows highly appreciated investors to liquidate and reinvest in real estate or a business on their own timetable or reallocate for income while delaying capital gains. I would like to do a deferred sales trust instead of a 1031 exchange on a residential property in Northern Virginia. Get Your Free Settlement Claim Review With A Top Law Firm Now.

These tax attorneys have unique expertise at. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Listen to the podcast here.

The house is free and clear. The pre-tax proceeds from the. On How Does The Deferred Sales Trust Work.

Are looking to sell something real estate a business a collection cars artwork stocks etc and are concerned about a hefty tax bill. However its not that well known because its proprietary in nature. We Win Cases Free Evaluation Get Started.

Deferred Sales Trust is a proprietary strategy developed by Todd Campbell Principal founding attorney of Campbell Law a CPA LLM and tax attorney for investors who. Ad 4 Simple Steps. Ad A 987 Client Satisfaction Rating.

Deferred Sales Trust DST a tool that allows you to legally defer your taxes 10 years. Deferred Sales Trust DST is a strategy thats been around for about 22 years.

Deferred Sales Trust Durfee Law Group

Attorneys And Deferred Sales Trust Reef Point Llc

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

![]()

Deferred Sales Trust Atlas 1031

Deferred Sales Trust Real Estate Tax Strategy

Deferred Sales Trust Vs 1031 Exchange Youtube

Get To Know The Deferred Sales Trust Team Reef Point Llc

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

The Cost Of Setting Up A Deferred Sales Trust Is Too High Or Is It Reef Point Llc

Pros And Cons Of The Deferred Sales Trust Reef Point Llc

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Avoid Capital Gains Tax Deferred Sales Trust Faqs

Attorneys And Deferred Sales Trust Reef Point Llc

Deferred Sales Trust Oklahoma Bar Association

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker